Insightful Updates

Stay informed with the latest news and trends.

Staking Coins While You Sleep: A Dreamy Dive into Crypto Staking Systems

Unlock passive income by staking coins while you sleep! Discover the secrets of crypto staking systems in this dreamy guide.

Understanding the Basics of Crypto Staking: How to Earn Passive Income

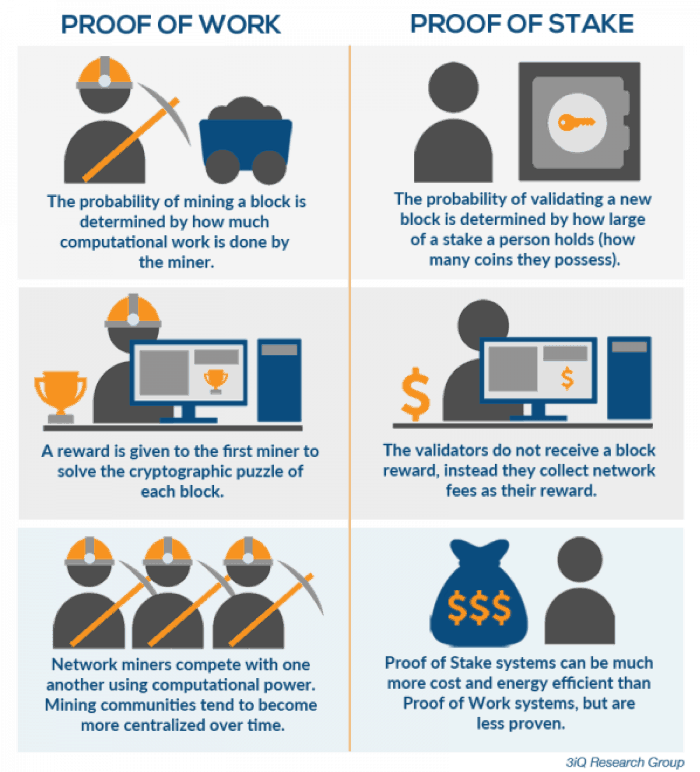

Crypto staking is a process that allows cryptocurrency holders to earn rewards by participating in the network's operations. Unlike traditional mining, which requires significant computational power and energy consumption, staking involves locking up a certain amount of cryptocurrency in a digital wallet to support the network's security and transaction validation. This mechanism benefits both the individual and the network, as it encourages users to hold their assets rather than sell them. Understanding the basics of crypto staking is essential for anyone looking to explore new avenues for passive income in the ever-evolving world of digital currencies.

The staking process generally involves a few straightforward steps: first, choose a cryptocurrency that supports staking, such as Ethereum 2.0 or Cardano. Next, set up a wallet that allows for staking. Once you have acquired the cryptocurrency, you can then stake your assets, often through a third-party platform or directly with the network, depending on the cryptocurrency's requirements. As your assets remain staked, you'll earn rewards in the form of additional coins or tokens, allowing you to build your portfolio over time. This method not only provides an opportunity for passive income but also contributes to the overall health and security of the blockchain.

Counter-Strike is a popular first-person shooter game that pits teams of terrorists against counter-terrorists in a variety of game modes. Players can purchase weapons and equipment at the start of each round, aiming to complete objectives or eliminate the opposing team. For exclusive rewards, you can check out the rollbit promo code that offers unique features and bonuses.

The Pros and Cons of Staking Coins: Is It Right for You?

Staking coins has become an increasingly popular way for cryptocurrency holders to generate passive income. Pros of staking include the potential for high returns, as stakers receive rewards in the form of additional coins for helping to secure the network. This process not only supports the blockchain's functionality but also allows users to participate in governance decisions by voting on proposals. Additionally, staking can be less demanding than trading, as it typically requires less active management compared to other investment forms, allowing investors to grow their assets over time.

However, staking coins is not without its cons. One significant downside is the risk of losing your investment due to market volatility; while staked coins can generate rewards, their value can decrease significantly during market downturns. Moreover, staking often requires locking up funds for a predetermined period, which can limit liquidity and prevent you from accessing your assets when you need them. To determine if staking is right for you, consider your risk tolerance, investment goals, and the specific staking requirements of the coins you are interested in.

How to Maximize Your Earnings: Tips for Successful Crypto Staking

In the world of cryptocurrency, staking has emerged as a popular method for investors to earn passive income. To maximize your earnings from crypto staking, it's essential to first understand the basics of the process. Start by selecting a reliable and high-performing blockchain network that offers staking rewards. Research various cryptocurrencies, focusing on their staking yields, lock-up periods, and the overall stability of the project. Consider diversifying your staking portfolio by investing in multiple assets that exhibit solid fundamentals and community support, which can help mitigate risks.

Once you've chosen your cryptocurrencies, the next step is to optimize your staking strategy. You can do this by following these tips for successful crypto staking:

- Stay informed: Regularly monitor market trends and news that may affect the value and staking rewards of your assets.

- Use staking pools: Joining a staking pool can enhance your chances of earning rewards, especially if you're staking a less popular cryptocurrency.

- Reinvest rewards: Consider reinvesting your staking rewards to compound your earnings over time.