Insightful Updates

Stay informed with the latest news and trends.

Whole Life Insurance: A Policy You Can Bank On

Discover why Whole Life Insurance is your best financial ally—secure your future and watch your wealth grow!

What is Whole Life Insurance and How Does It Work?

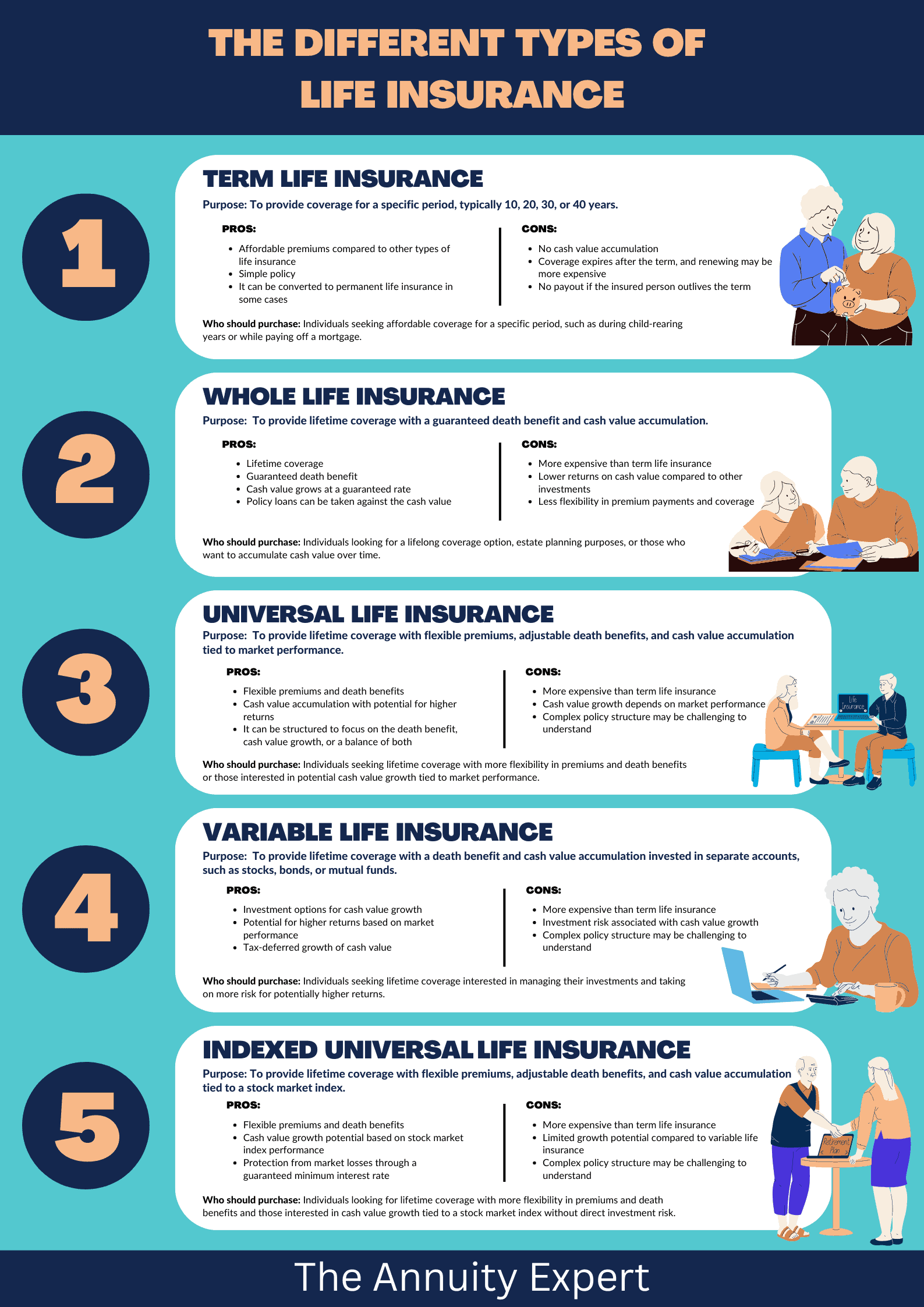

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as the premiums are paid. This insurance policy not only offers a death benefit to the beneficiaries upon the policyholder's passing but also accumulates a cash value over time. The cash value is a portion of the premium that is invested by the insurance company and grows at a guaranteed rate. This unique feature makes whole life insurance a dual-purpose financial tool: it provides protection for loved ones and serves as a savings component that policyholders can borrow against or withdraw from in times of need.

Understanding how whole life insurance works is essential for making informed financial decisions. When a policyholder pays their premiums, a portion goes towards the death benefit, while another portion builds the cash value. Generally, the policyholder can access the cash value through loans or withdrawals, although this may reduce the death benefit if not repaid. Additionally, whole life insurance premiums are typically fixed and do not increase over time, making it easier for individuals to budget for long-term financial planning. Overall, whole life insurance offers a sense of security and peace of mind, combining lifelong coverage with the potential for financial growth.

Top 5 Benefits of Choosing Whole Life Insurance

Whole life insurance offers several compelling advantages that make it a valuable investment for individuals looking to secure their financial future. One of the primary benefits is the guaranteed cash value accumulation. Unlike term life insurance, whole life policies build cash value over time, which policyholders can borrow against or withdraw from as needed. This feature not only provides a safety net for emergencies but also acts as a forced savings mechanism, allowing individuals to grow their wealth over time.

Another key benefit of whole life insurance is the stability it provides. With fixed premiums and a death benefit guaranteed for the insured's lifetime, policyholders can enjoy peace of mind knowing that their loved ones will be financially secure in the event of their passing. Additionally, whole life insurance can serve as a long-term investment strategy, offering potential dividends that can further enhance the policy's cash value. Overall, choosing whole life insurance ensures both protection and financial growth.

Is Whole Life Insurance a Smart Investment for Your Financial Future?

When considering whether whole life insurance is a smart investment for your financial future, it's essential to examine its benefits and drawbacks. Whole life insurance provides a death benefit to your beneficiaries, as well as a cash value component that grows over time. This cash value can be borrowed against or withdrawn, offering potential liquidity that can be useful for unexpected expenses or investment opportunities. Additionally, whole life policies typically come with a guaranteed rate of return, making them a stable choice compared to more volatile investment options such as stocks or mutual funds.

However, it's important to recognize that whole life insurance can be more expensive than term life insurance, which may provide higher coverage at a lower cost. Investing in whole life insurance should be viewed in the context of your overall financial goals and needs. For some, the peace of mind that comes with having a guaranteed death benefit and a growing cash value may outweigh the costs. Ultimately, evaluating your personal circumstances and consulting with a financial advisor can help determine if whole life insurance is the right addition to your investment portfolio.